By Krystal Hu

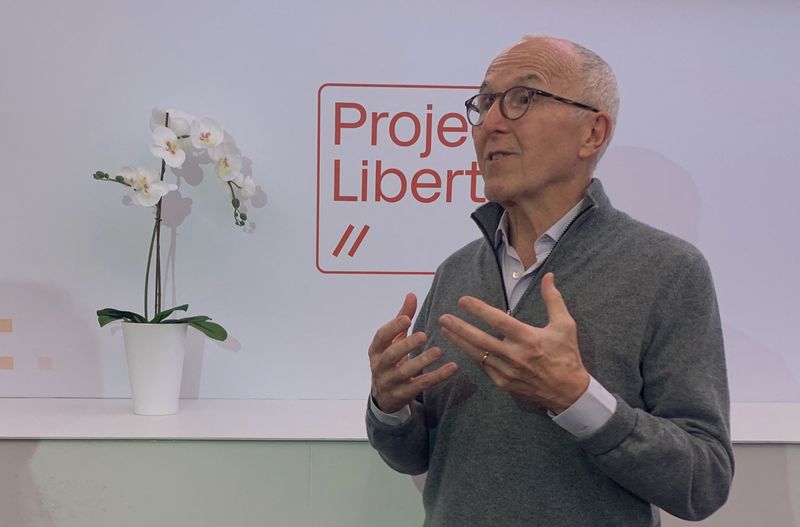

DAVOS, Switzerland (Reuters) -U.S. businessman Frank McCourt is open to teaming up with other buyers on a bid to take over the U.S. operations of TikTok as long as he can maintain control of the asset, he told Reuters at the Davos event on Thursday.

The billionaire declined to share details on his sources of financing, but said private equity firms and family offices have reached out to provide options.

“Capital is not the issue here. The issue here is waiting for (TikTok parent) ByteDance, or the Chinese government to make a decision about the future of U.S. TikTok,” said McCourt, who spoke on the sidelines of the World Economic Forum in Davos, Switzerland.

The flexibility in his much-publicized bid came shortly after U.S. President Donald Trump signed an executive order on Monday delaying the enforcement of a ban on the Chinese-owned popular short-video app by 75 days.

Trump also said this week he “would like the United States to have a 50% ownership position in a joint venture” in TikTok, and that he was open to billionaires Elon Musk or Larry Ellison, chairman of Oracle (NYSE:ORCL), buying the social media app.

McCourt’s Project Liberty advocacy group submitted a bid to buy the U.S. assets of TikTok in early January with plans to run the app on the group’s technology which aims to let users choose how their data will be used and shared. TikTok has sued to block the U.S. ban but the Supreme Court upheld it in a decision last week.

BIDDERS

The prospect of gaining ownership over one of the world’s most recognized video sharing platforms, or at least its U.S. audience, has drawn an increasingly long list of people and entities ranging from the world of finance, technology and entertainment.

Many in Trump’s orbit, or with close ties to the president, have been linked with TikTok ever since the U.S. ban became a possibility under the administration of President Joe Biden. Former Treasury Secretary Steven Mnuchin said in March he was building a consortium of investors to bid on TikTok.

Others who have expressed interest range from the CEO of Kingdom (TADAWUL:4280) Holding, the investment firm of Saudi Arabia’s Prince Alwaleed Bin Talal which was previously a large investor in what was then called Twitter, to a consortium of U.S. investors including Jimmy Donaldson, better known by his online persona “MrBeast.”

But what they are actually competing to buy remains a mystery, and that is before potential bidders start to answer questions around how they will finance a deal.

Existing investors in TikTok have shown support by expressing interest to roll over partial or all stakes in a deal, according to McCourt, which potentially reduces the capital needed to pull off the purchase that could cost $20 billion without the inclusion of TikTok’s algorithm.

SUPPORT

In a meeting with the U.S. House of Representatives’ select committee on China earlier this week, McCourt and his co-bidder Kevin O’Leary received assurances that lawmakers on both sides of the U.S. political aisle are committed to ensuring a qualified divestiture.

“I came away with a very clear impression that the (U.S.) Congress was quite unified on enforcing the legislation and causing either a ban or sale of U.S. TikTok,” said McCourt.

To McCourt, who said he has never used TikTok, the most appealing assets of the app are the users, data and the brand. His bid for TikTok does not include buying the algorithm for TikTok’s recommendation system, which is at the heart of the app’s popularity.

He wants to move TikTok’s 170 million U.S. users to his own Project Liberty platform with digital infrastructure in the U.S., and expects that the migration could be completed within a year if a deal happens.

McCourt said he was flexible on financial arrangements of ownership as long as he can maintain control and move TikTok users to digital infrastructure developed by Project Liberty.

“This is not just about who will pay the most money,” he said. “This is about who can meet the very strict criteria laid out in the legislation and reaffirmed by the Supreme Court.”